Economic Effects

Taking Down This Monument to Injustice Will Help Millions

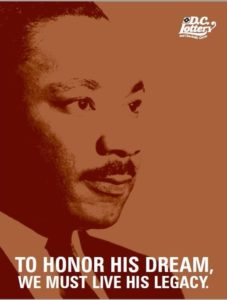

An actual District of Columbia Lottery ad

(Note: The image above is the $100 lottery scratch ticket the Texas Lottery is selling in low-income communities across the state where citizens earn $7.25 an hour. The MLK image on the left is AN ACTUAL AD that the District of Columbia Lottery used to market lottery tickets.)

In the euphoria of winning the first major legislative action against slavery in modern history by abolishing the British slave trade in 1807, the English abolitionist Henry Thornton was asked what issue should be the nation’s next important fight. His answer: “The Lottery, I think.”

Ridiculous, you say. Why would one of history’s foremost campaigners for the abolition of the slave trade rank lotteries among society’s biggest injustices? Because of the life-changing financial losses that citizens suffer as a result of state lotteries. Here in the U.S., more than $500 billion of personal wealth will be lost by citizens to lotteries over the next eight years, much of it taken from African-American families.

State attorneys general have sued opioid makers, tobacco companies, polluters, and many other businesses for the damage their predatory, deceptive, and destructive practices inflicted upon the public. Yet not a single state attorney general has ever sued a lottery for the financial and social damage they have caused millions of American families.

Why? Because many public officials now consider lotteries an essential source of government revenue. So essential in fact that while public schools and other core state government functions were shut down because of COVID-19, every state lottery was still selling tickets. Several lotteries broke sales records for scratch tickets soon after economic stimulus checks and extra $600 weekly unemployment benefits began arriving to citizens.

Where does the hundreds of billions of dollars of wealth lost to lotteries go? Several states claim lottery revenues “fund public schools.” In California, the lottery contributes just 1% of the total K-12 education budget. In New York, it’s under 5%. In states like Georgia and South Carolina, lottery revenues are used to fund college scholarships, many of which go to students from middle-class to upper-middle class families. And in some states, like Colorado and Oregon, lottery profits are used to fund parks and other environmental protection projects because to be green, you need “the green.” Where the money comes from appears to be a secondary matter.

Like six-story high Robert E. Lee statues, we have been told state lotteries are part of “our heritage.” Yet the willfully-neglected truth is state lotteries are a contributor to the massive wealth disparity between whites and blacks. Nationwide, African Americans spend five times more on lottery tickets than white people.

The path to wealth is not just about how much you make, which is the side of the ledger almost always attracting public attention. It’s also about how much you keep. While differences in income are a major contributing factor, the disparity between whites and blacks in the accumulation of wealth-building assets is staggering. According to the Federal Reserve, 60% of whites have a retirement fund while only 34% of blacks; 73% of whites own a primary residence but only 45% of blacks; and 61% of whites own publicly-traded stocks compared to just 31% of blacks.

Building assets and the accumulating and investing of savings are the keys to financial peace. Owning a home, a college fund, retirement accounts, and a stock portfolio are the hallmarks of middle and upper class America, and these assets are all the result of savings. With fewer African-Americans and people of color holding these essential assets, they miss out on higher average returns than low-risk assets, as well as the power of compound interest.

Creating wealth by the accumulation of assets and the investment of savings is the direct opposite of what state lotteries represent and encourage. “The Fastest Way to a Million Dollars,” “Road to Riches,” “$200,000 a Year for Life,” “$10,000,000 Bankroll,” and “$7,000,000 Supercash” are just a sampling of the hundreds of different lottery scratch tickets that state governments across the United States are marketing at this very moment during a time when more than 20 million citizens are unemployed, of which a disproportionate amount are African-American.

But no one is forcing people to gamble away their future financial security on state lottery games, you say. While true, it is more like luring people into a life-changing financial trap difficult to escape. State governments deliberately concentrate lottery outlets in economically-distressed regions to entice more low-income citizens, often clustering outlets in neighborhoods with large numbers of minorities. Lotteries also aggressively target these communities with marketing campaigns exempted from truth-in-advertising laws under the Federal Trade Commission.

The types of gambling that used to occur in African-American neighborhoods before states imposed lotteries were local and private, and the money exchanged stayed in the community. Today, much of the tens of billions of dollars that lotteries extract from low-income and minority communities is redistributed to benefit residents of middle-class and upper-class communities. In one example representative of many others, a 2018 investigation by The State newspaper in South Carolina found Orangeburg County in the state had the 11th highest poverty rate and had spent $1,274 per person on the lottery since 2008 — more than any other county. But for every dollar Orangeburg County residents had spent on the lottery, they have received just 41 cents in scholarships, K-12 funding and other lottery funds. In contrast, Pickens County, which has the 15th lowest poverty rate, had spent $141 per person on the lottery since 2008, the least of any county. But for every dollar Pickens County residents spent, they received $3.26 in scholarships, K-12 funding and other lottery funds.

While the wealth lost to gambling now goes elsewhere, state lotteries leave another brand on black lives, especially black women: a severe gambling addiction problem. Results of a large nationally-representative study that investigated ethnicity and rates of problem gambling found that African-Americans had twice the rate of gambling addiction compared to whites and they were also more likely to be women in the lowest income brackets.

To keep the money pouring in, states labor to entice citizens to gamble with an ever-growing amount of new games and new forms of gambling, at higher price points, played at faster speeds, with more frequency, at more locations.

Lotteries are now lobbying hard to massively expand their gambling operation onto the internet, allowing them to open a virtual lottery outlet on every smart phone, tablet, and computer in a state. The future of lotteries depends on their ability to lure a whole new generation of young people to develop a gambling habit.

We don’t ban alcohol and tobacco sales in African-American neighborhoods to prevent people from developing a drinking or smoking habit, so why shut state lottery outlets? What separates commercialized gambling like lotteries from every other business, including vices like alcohol and tobacco, is it’s a big con game based on deceit and exploitation. Lottery games are a form of consumer financial fraud, similar to price-gouging and false advertising. Citizens are conned into thinking they can win money on games that are designed to get them fleeced in the end. If you pay for a pizza, a ticket to a sporting event, or a glass of wine, that’s what you receive in return. With state lotteries, what you receive is a financial exchange offering the lure that you might win money. But this financial exchange is mathematically rigged against you so inevitably you lose your money in the end, especially if you keep gambling. Any success only comes at someone else’s expense. All of this explains why lotteries are illegal unless you run the gambling scheme in partnership with state government.

How do you start to address the problem of state lotteries in America? The first step is to eliminate lottery advertising, marketing promotions, and sponsorships. What leads people to lottery games is the marketing.

A second step is to end the sale of high dollar gambling games, especially in financially-disadvantaged communities. Some states sell scratch tickets as high as $50 in neighborhoods where many residents make a minimum wage of $7.25 an hour.

A third step is for state legislatures to begin building a Lottery Replacement Fund which would act like a rainy day fund dedicated to helping wean the state from lottery revenues over a period of years.

As almost every facet of American life is rightly being scrutinized for its impact on black lives, state lotteries deserve to be included on center stage. It has been a long time coming.

– Authored by Les Bernal of Stop Predatory Gambling

Annotation:

1) Rev. Martin Luther King’s likeness and message was perverted by the District of Columbia Lottery to market lottery tickets to citizens in a community with a large population of African-Americans. https://www.stoppredatorygambling.org/wp-content/uploads/2020/07/DC-Lottery-ad-MLK-Martin-Luther-King-e1594605846737.jpg

2) Thornton quote on lotteries: “Bury the Chains,” Adam Hochschild, Pg. 308

3) “$500 billion of personal wealth will be lost by citizens to lotteries over the next eight years…” H2 Gambling Capital https://h2gc.com/ tracks gambling loss figures. The Economist has published these numbers. https://www.economist.com/graphic-detail/2017/02/09/the-worlds-biggest-gamblers US losses to lotteries are at least $70 billion a year and over an eight year period total losses will exceed $560 billion.

4) “lotteries are considered ‘essential’ during COVID pandemic” and “lotteries broke sales records” during COVID shutdown:

“Coronavirus Crisis Prompts Call to Suspend Lottery Gambling; Antilottery group asks states to suspend lotteries until 30 days after stimulus payments,” The Wall Street Journal https://www.wsj.com/articles/coronavirus-crisis-prompts-call-to-suspend-lottery-gambling-11587376800?mod=searchresults&page=1&pos=1#comments_sector

“Scratch-Off Lottery Sales Soar,” Stateline Pew Charitable Trusts https://www.pewtrusts.org/en/research-and-analysis/blogs/stateline/2020/05/13/scratch-off-lottery-sales-soar

“Chasing Sales During Coronavirus Pandemic, States Declare Lotteries ‘Essential'” The Intercept https://theintercept.com/2020/04/16/coronavirus-state-lotteries-gambling-essential/

5) “In California, the lottery contributes just 1% of the total K-12 education budget…” https://www.cde.ca.gov/fg/aa/lo/ceflottery.asp

6) “In New York, it’s under 5%.” https://www.wgrz.com/article/news/education/how-much-lottery-money-really-goes-to-education/71-607297164

7) “In states like Georgia and South Carolina…” low income and minority citizens are funding college scholarships for middle and upper middle class kids: Atlanta Journal Constitution https://www.ajc.com/news/state–regional-govt–politics/now-what-has-hope-accomplished/7tvZcMVQGSKQ19VDOgOc3M/ and The State Newspaper, South Carolina: https://www.greenvilleonline.com/story/news/2018/10/12/south-carolinas-poor-play-lottery-but-wealthier-win-scholarships/1614069002/

8) Environmental protection groups in CO and OR receive money lost by low income citizens buying lottery tickets: Colorado https://www.coloradolottery.com/giving-back/funding/ and Oregon https://www.oregonlottery.org/oregon-wins/

9) “Nationwide, African Americans spend five times more on lottery tickets than white people.” Source: “State Lotteries at the Turn of the Century: Report to the National Gambling Impact Study Commission,” Charles Clotfelter, Philip J. Cook, Julie A. Edell and Marian Moore, all of Duke University http://govinfo.library.unt.edu/ngisc/reports/lotfinal.pdf

10) Statistics on the massive asset gap between whites and blacks came from US Federal Reserve Board Survey on Consumer Finances, 2016 and graphed by https://www.visualcapitalist.com/racial-wealth-gap/

11) Samples of lottery tickets:

“The Fastest Way to a Million Dollars,” GA Lottery https://www.galottery.com/en-us/games/scratchers/active-games.html

“Road to Riches,” WI Lottery https://wilottery.com/games/instant-games/road-riches-2139

“$200,000 a Year for Life,” MA Lottery https://www.masslottery.com/games/200k_year_for_life_2017

“$10,000,000 bankroll,” MA Lottery https://www.masslottery.com/games/10m_bankroll_2019

“$7,000,000 Supercash” NY Lottery https://nylottery.ny.gov/scratch-off/ten-and-up/7000000-supercash

12) “State governments deliberately concentrate lottery outlets in economically-distressed regions to entice more low-income citizens, often clustering outlets in neighborhoods with large numbers of minorities.”

Source: “A geospatial statistical analysis of the density of lottery outlets within ethnically concentrated neighborhoods,” Journal of Community Psychology, April 2010 https://onlinelibrary.wiley.com/doi/abs/10.1002/jcop.20376

13) “Lotteries also aggressively target these communities with marketing campaigns exempted from truth-in-advertising laws under the Federal Trade Commission.” “The Predatory Nature of State Lotteries,” Loyola Consumer Law Review, Andrew Clott, 2015 https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwi48dWzysjqAhVVlnIEHcDdCaAQFjALegQIBBAB&url=https%3A%2F%2Flawecommons.luc.edu%2Fcgi%2Fviewcontent.cgi%3Farticle%3D1964%26context%3Dlclr&usg=AOvVaw3iQ5Co3C6j7Dd2lOiWADRO

14) “Much of the tens of billions of dollars extracted from these low-income and minority communities by state lotteries every year is redistributed to benefit residents of middle-class and upper-class communities. For example, a 2018 investigation by The State newspaper in South Carolina….” Source: The State Newspaper, October 12, 2018 https://www.greenvilleonline.com/story/news/2018/10/12/south-carolinas-poor-play-lottery-but-wealthier-win-scholarships/1614069002/

15) “The types of gambling that used to occur in African-American neighborhoods before states imposed lotteries were local and private, and the money exchanged stayed in the community. “ Source: “Running the Numbers: Race, Police, and the History of Urban Gambling,” Matthew Vaz, 2020 https://press.uchicago.edu/ucp/books/book/chicago/R/bo49299126.html

16) “Results of a large nationally-representative study that investigated ethnicity and rates of problem gambling found that African-Americans had twice the rate of gambling addiction compared to whites and they were also more likely to be women in the lowest income brackets.” Source: “Disordered gambling among racial and ethnic groups in the US: results from the national epidemiologic survey on alcohol and related conditions,” Alegria AA, Petry NM, Hasin DS, Liu SM, Grant BF, Blanco C CNS Spectr. 2009 Mar; 14(3):132-42. https://pubmed.ncbi.nlm.nih.gov/19407710/

17) “Some states sell scratch tickets as high as $50 in neighborhoods where many residents make a minimum wage of $7.25 an hour.” Texas Lottery $50 scratch tickets: https://www.txlottery.org/export/sites/lottery/Games/Scratch_Offs/index.html_635453064.html

Texas minimum wage is $7.25 an hour: https://squareup.com/us/en/townsquare/your-guide-to-texas-minimum-wage

Why Commercialized Gambling is Different Than Any Other Business

Below is the testimony of Les Bernal, National Director of Stop Predatory Gambling, before a Georgia Legislature study committee on gambling in October 2019. As part of his presentation, Bernal explains why commercialized gambling is different than any other business. A copy of Bernal’s slides can be found here.

Warren Buffett Speaks Out Against Government-Sanctioned Gambling

Philadelphia Federal Reserve Bank: Costs of Predatory Gambling Outweigh Any Benefits

This report from the Federal Reserve Bank of Philadelphia concludes that the local benefits of casinos would be outweighed by costs such as increases in pathological gambling, crime and personal bankruptcy.

Australian Government Study Reveals the Spectacular Failure of Government-Sanctioned Gambling

This report from the Productivity Commission of Australia (the Australian Government’s independent research and advisory body) provides an in-depth analysis of the effects of the predatory gambling industry on the nation. Gambling, and specifically “pokies” or video slot machines, became pervasive across almost the entire Australian nation by 1995.

Community backlash against slot machines in Switzerland caused the nation to ban slot machines outside of casinos in 2005. Widespread concerns in Russia about gamblers losing their life savings and becoming destitute caused that country to ban all gambling, other than in four highly remote regions. Due to increased problem gambling, Norway banned all video slot machines in 2007 and Internet gambling in 2009. The Norwegian gambling authority is implementing “less aggressive” (slower play, low maximum loss rates) gambling machines in smaller numbers than the banned slots.

The major conclusions from the Australian report are:

* Gambling now costs Australian society about $4.5 billion dollars per year, the bulk of costs deriving from video slot machines. These costs exceed benefits when “excess” losses by problem gamblers is included. Cost per year per adult translates to $210. $1 U.S. dollar = $1.08 in Australian dollars as of Oct 23, 2009.

* 42 to 75 percent of total machine losses are paid by moderate and high risk problem gamblers.

* Gambling machines, as contrasted to other forms of gambling such as lottery or tables games account for around 75–80 percent of ‘problem gamblers’ and are found to pose significant problems for ordinary consumers.

* About 2.5 percent of Australian adults are now problem gamblers.

* 8 to 15 percent of Australian problem gamblers seek treatment. “Internationally, around 6-15 per cent of people experiencing problems with gambling are reported to seek help from problem gambling services…People experiencing problems with their gambling often do not seek professional help until a ‘crisis’ occurs — financial ruin, relationship break down, court charges or attempted suicide — or when they hit ‘rock bottom.’

* Help services for problem gamblers using them have worked well overall, but they relate to people who have already developed major problems and are thus not a substitute for preventative measures.

* The potential for significant harm from some types of gambling is what distinguishes gambling from most other enjoyable recreational activities — and underlines the communities’ ambivalence towards it. While many Australians gamble, they remain skeptical about the overall community benefits. For instance, one survey estimated that around 80 percent of Victorian adults considered that gambling had done more harm than good (with little difference between the views of gamblers and non-gamblers). Looking at all Australian surveys, roughly 80 percent of the public wants to see video slot machines removed or their numbers reduced.

* Many people who do not fit the strict criteria for problem gambling are found to experience significant harms. For example, of those people who said that gambling had affected their job performance, some 60 percent were not categorized as ‘problem gamblers.’

* 39 percent of high risk problem gamblers suffered adverse effects on workplace performance.

* Had there been full knowledge at the time about the harmful effects of substantially increasing accessibility to gaming machines in the 1990s, a different model of liberalization, with less widespread accessibility, may well have been seen as appropriate. Western Australia did not follow the approach of other jurisdictions and appears to have far fewer gambling problems.

* The effect of widespread gambling machine availability on the economy can be seen in Australia, where gambling losses reached 3.1 percent of household consumption, 6.3 percent in Northern Australia.

* Beyond the powerful example provided by the early liberalization experiences of Australia, there is a broad range of evidence suggesting a link between proximity and harm.

* 60 percent of Australian teens gamble on video slot machines by the time they are 18 years of age. Over 60 percent of Aussie teens have gambled in some form before they reached 18 years.

* Increased knowledge of gambling in children may have the unintended consequence of intensifying harmful behavior, a risk that should be considered in the design (or even in considering the introduction) of school-based programs. Nevertheless, several insights emerge from the drug, alcohol and driver education literature that may increase the effectiveness of any school-based gambling education programs and potentially reduce the risks of adverse behavioral responses: a school-based education program may be more effective if accompanied by a corresponding change in societal attitudes and a media campaign. For instance, the relatively greater success of school-based tobacco programs (compared with alcohol) is attributed to the fact that these were accompanied by consistent anti–smoking messages in the general media and to the emergence of a strong anti–smoking social movement.

* Australian gamblers are estimated to lose A$790 million per year, about 4 percent of the size of legal gambling, in illegal online gambling and Internet casinos.

* The report found that slot machines are between 6 and 18 times more risky than lotteries

* Around 50 per cent of gaming machine gamblers have false beliefs about how gaming machines work, which pose risks to them…’Faulty cognition’ about slot machine design is strongly associated with problem gambling. 33 percent of high-risk problem gamblers, 20 percent of moderate risk, and 5 percent of recreational gamblers believe that a gambler is more likely to win on a slot machine after losing many times in a row. Some groups of consumers — such as people with intellectual or mental health disabilities, poor English skills, and those who are emotionally fragile (say due to grief) — may be particularly vulnerable to problems when gambling.

Casinos Failed to Bring Prosperity to Connecticut

Despite developing two of the largest casinos on the planet in the 1990s, the state of Connecticut is in dire fiscal shape. The New York Times piece below states that “Connecticut’s finances are among the most troubled in the nation: it is last or close to last in financing pension obligations and retaining reserves for emergencies, and near the top in per-capita debt…Moody’s lowered its outlook for the state’s bond rating to negative from stable.” This is just another example that casinos fail to provide the revenue promised by lobbyists of the predatory gambling trade. And what about jobs? The state has “an abysmal level of job creation and economic growth that has left the state with fewer workers employed now than in 1987.”

Government’s Predatory Gambling Program Surpasses the Predatory Subprime Lending Business

Prior to the massive crash of the highly-predatory subprime lending business which nearly every state Attorney General sued for their predatory practices, former Harrah’s top executive Rich Mirman boasted to Wall Street Journal reporter Christina Binkley: “I worked in the subprime lending industry. At least casinos are open about what they do.”

The infamous subprime lender Countrywide Mortgage made a lot of money and employed a lot of people by selling bad loans to citizens who could never afford to pay them back. Countrywide’s “success” was phony prosperity and it caused major damage to our economy which all of us are still paying for today. Presently, our state governments across the U.S. are full partners with corporate gambling operators whose business practices go far beyond failed subprime lenders like Countrywide.

It’s time for Atlantic City to end its failed experiment

Atlantic City, perhaps more than anywhere else, is a microcosm of what goes wrong when casinos are adopted as the main source of revenue for a city. The city now faces competition from other casinos in the northeast, which is leading to plummeting revenues and soaring unemployment rates, because the city put all of its proverbial eggs in the basket that is casinos, opting not to attempt to revitalize the city a whole, which may have prevented the city’s current economic tailspin. This article from the New York Post argues that the only way to save Atlantic City is to drop the failed casino experiment and try investing in a long-term solution to the difficult economic problems the city faces.

A good way to wreck a local economy…bring in casinos

This story by David Frum, former advisor to President George W. Bush and current Senior Editor with Atlantic Monthly, spotlights how casinos hurt local economies: “The towns and cities that turned to gambling to escape their problems may discover that they have accepted a sucker’s bet: local economies that look worse than ever, local residents tempted into new forms of self-destructive behavior, and a dwindling flow of cash to show for it all.”